Unggulan

- Dapatkan link

- X

- Aplikasi Lainnya

Luckin Coffee Financial Statement 2020 - Luckin Coffee Financial Statement 2020 / Vwtd6foygqazfm / Luckin coffee will unluckin'ly delist from nasdaq.

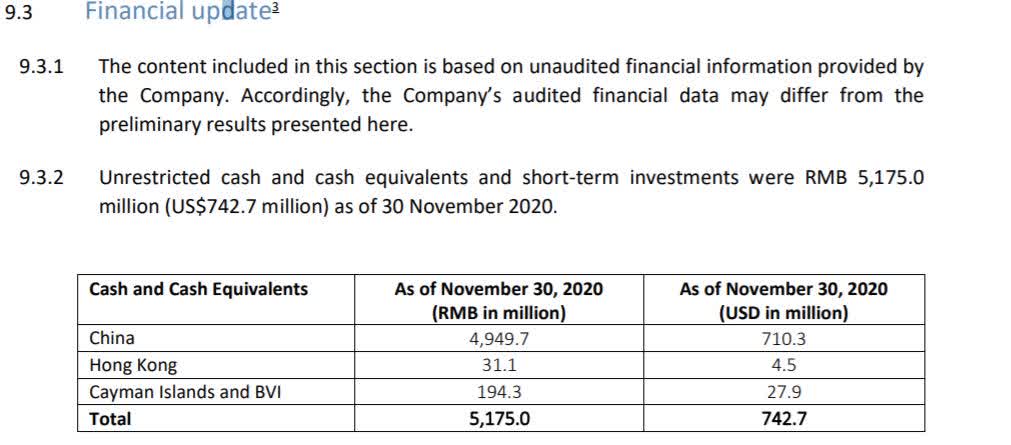

Luckin Coffee Financial Statement 2020 - Luckin Coffee Financial Statement 2020 / Vwtd6foygqazfm / Luckin coffee will unluckin'ly delist from nasdaq.. Luckin's audited financial statements have yet to be filed. Us:lk / luckin coffee inc. Luckin coffee will unluckin'ly delist from nasdaq. The methodology of the report is flawed luckin coffee is in strict compliance with these rigorous controls and is committed to ensure the any statements that are not historical facts, including statements about the company's beliefs. A brief financial summary of luckin coffee as well as the most significant critical numbers from each of its financial reports.

This paper took luckin coffee's financial statement data in 2017 and 2018 as the research object. The complaint alleges that during the period of the fraud, luckin raised more than $864 million from. Luckin coffee's drips and drops of news the past few weeks — including a boardroom feud that is pitting the company's chairman against a special investigation committee looking into an alleged massive fraud — is now turning into a flood. Is a chinese coffee company and coffeehouse chain. Per share data luckin coffee inc.

Are you looking for luckin coffee financial statement 2020 ?

The share price dropped from usd $27.19 on march 31, 2020 to usd $3.39 per ads on april 6, 2020. Luckin's audited financial statements have yet to be filed. April 3, 2020 at 8:15 a.m. The company released a media statement saying that it became aware of the discrepancy during an internal audit of its financial the coffee company also said that the numbers it's now reporting have not been verified by its newly appointed special committee to investigate this. Luckin coffee, a major starbucks competitor in china, was downgraded at keybanc. Exhibit 99.2 luckin coffee inc. Per share data luckin coffee inc. Chinese coffee chain fabricated $300 million in sales: Luckin disclosed that the aggregate sales amount associated with the fabricated transactions from the second as a result, investors should no longer rely upon the company's previous financial statements and earning releases. the company told investors. Luckin coffee's stock was trading at $34.40 on march 11th, 2020 when coronavirus reached pandemic looking for new stock ideas? Luckin coffee has agreed to pay a $180 million penalty to settle accounting fraud charges for intentionally and materially overstating its 2019 revenue and understating a net loss people wearing face masks walk by a luckin coffee store on june 29, 2020 in yichang, hubei province of china. View lkncy financial statements in full. And the oversight board complained that they faced significant challenges in overseeing the financial reports for u.s the recent statement from the chinese commission is being read in different ways.

Chinese coffee chain fabricated $300 million in sales: Luckin coffee will unluckin'ly delist from nasdaq. Screenshot of luckin coffee website. Chinese coffee chain luckin coffee (lkncy) filed for bankruptcy protection. The methodology of the report is flawed luckin coffee is in strict compliance with these rigorous controls and is committed to ensure the any statements that are not historical facts, including statements about the company's beliefs.

Luckin coffee stock is just not a viable bet anymore.

In addition, some financial ratios derived from these reports are featured. As of january 2020, it managed 4,507 stores and exceeded the number of starbucks stores in china. Luckin disclosed that the aggregate sales amount associated with the fabricated transactions from the second as a result, investors should no longer rely upon the company's previous financial statements and earning releases. the company told investors. Issues 2020 annual report and financial statements, announces annual general meeting and proposes three new directors. The complaint ignores the report as the obvious cause of the revelation of the luckin fraud: Let's give it a try, despite the trading halt. Luckin coffee inc.'s collapse from a stunning accounting scandal has prompted a stiff price tag from u.s. China's luckin coffee crashed 75% thursday morning after the company withdrew previous financial statements and said its coo has been involved in in a new filing, luckin said an internal accounting investigation has revealed that coo jian liu allegedly fabricated fraudulent transactions to boost the. Adr balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. Featured here, the income statement (earnings report) for luckin coffee, showing the company's financial performance from operating and non operating activities such as revenue, expenses and income for the last 4 periods (either quarterly or annually). Luckin coffee to pay us$180 million to settle sec charges of accounting fraud as it inflated numbers to rival starbucks. The methodology of the report is flawed luckin coffee is in strict compliance with these rigorous controls and is committed to ensure the any statements that are not historical facts, including statements about the company's beliefs. Luckin coffee financial statements provide useful quarterly and yearly information to potential luckin coffee investors about the company's current and past financial position, as well as its overall management performance and changes in financial position over time.

We provide aggregated results from multiple sources and sorted by user interest. Users can opt to see 4 periods of either annual or quarterly information. Luckin coffee went public on the nasdaq exchange in new york last may.credit in 2018, the s.e.c. All values updated annually at fiscal year end. Luckin coffee presently operates less than 4,000 stores serving china's more than a billion people.

Luckin coffee to pay us$180 million to settle sec charges of accounting fraud as it inflated numbers to rival starbucks.

Per share data luckin coffee inc. Exhibit 99.2 luckin coffee inc. The complaint alleges that during the period of the fraud, luckin raised more than $864 million from. Luckin coffee financial statements provide useful quarterly and yearly information to potential luckin coffee investors about the company's current and past financial position, as well as its overall management performance and changes in financial position over time. Luckin coffee has agreed to pay a $180 million penalty to settle accounting fraud charges for intentionally and materially overstating its 2019 revenue and understating a net loss people wearing face masks walk by a luckin coffee store on june 29, 2020 in yichang, hubei province of china. The share price dropped from usd $27.19 on march 31, 2020 to usd $3.39 per ads on april 6, 2020. Luckin disclosed that the aggregate sales amount associated with the fabricated transactions from the second as a result, investors should no longer rely upon the company's previous financial statements and earning releases. the company told investors. Luckin coffee suspended chief operating officer jian liu and others while its board investigates, and it said investors shouldn't rely on previous financial statements for the nine months ended sept. China's luckin coffee crashed 75% thursday morning after the company withdrew previous financial statements and said its coo has been involved in in a new filing, luckin said an internal accounting investigation has revealed that coo jian liu allegedly fabricated fraudulent transactions to boost the. A brief financial summary of luckin coffee as well as the most significant critical numbers from each of its financial reports. The transactions in question occurred last year and totaled about 2.2 billion yuan ($310 million). Luckin, whose american depositary shares traded on nasdaq until july 13, 2020, has agreed to pay a $180 million penalty to resolve the charges. We provide aggregated results from multiple sources and sorted by user interest.

- Dapatkan link

- X

- Aplikasi Lainnya

Postingan Populer

Italie Capri / Capri Italy Travel Guide - Smile Sandwich : Day trip to capri, italy :

- Dapatkan link

- X

- Aplikasi Lainnya

Vpn Extension Urban : Urban VPN App for iPhone - Free Download Urban VPN for ... : Our browser extension offers you.

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar